Contents:

Theretained earnings are announced by the company to the people to increase their confidence among shareholders and investors. The statement is useful for the company as well as other individuals. One can analyze the retained earnings statement to calculate the possible earnings of the company. Shareholder equity (also referred to as “shareholders’ equity”) is made up of paid-in capital, retained earnings, and other comprehensive income after liabilities have been paid.

Dividend Meaning: What Is It & How Does It Work? – Forbes Advisor … – Forbes

Dividend Meaning: What Is It & How Does It Work? – Forbes Advisor ….

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

Treasury shares continue to count as issued shares, but they are not considered to be outstanding and are thus not included in dividends or the calculation of earnings per share . Treasury shares can always be reissued back to stockholders for purchase when companies need to raise more capital. If a company doesn’t wish to hang on to the shares for future financing, it can choose to retire the shares. This figure is calculated by subtracting total liabilities from total assets; alternatively, it can be calculated by taking the sum of share capital and retained earnings, less treasury stock.

Retained Earnings Formula

On the other hand, it could be indicative of a company that should consider paying more dividends to its shareholders. This, of course, depends on whether the company has been pursuing profitable growth opportunities. One way to assess how successful a company is in using retained money is to look at a key factor called retained earnings to market value.

FG Corp should record the following entry to transfer additional paid-in capital to the par value of common stock. It is important to note that, irrespective of the type of dividends, any dividend payment will reduce retained earnings. The profits go into the company for use to pay down debt and to increase owner’s equity. The account for a sole proprietor is a capital account showing the net amount of equity from owner investments.

Do Dividends Affect Net Income?

It’s calculated by taking a company’s balance sheet , adding intangible assets like brand equity and patents, and subtracting intangible liabilities like accounts payable and pension obligations. The statement of retained earnings can be created as a standalone document or be appended to another financial statement, such as the balance sheet or income statement. The statement can be prepared to cover a specified cycle, either monthly, quarterly or annually. In the United States, it is required to follow the Generally Accepted Accounting Principles . Paid-in capital comprises amounts contributed by shareholders during an equity-raising event. Other comprehensive income includes items not shown in the income statement but which affect a company’s book value of equity.

Alpine Income Property Trust: Stable Return Play Until Next Bull … – Seeking Alpha

Alpine Income Property Trust: Stable Return Play Until Next Bull ….

Posted: Sun, 02 Apr 2023 07:00:00 GMT [source]

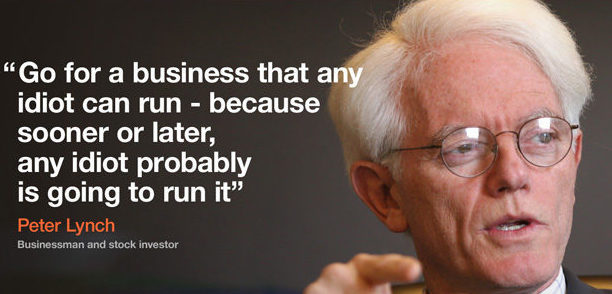

To find net income using retained earnings, you need to subtract the previous financial period’s recorded retained earnings called beginning retained earnings and add dividends back in. Beginning period retained earnings are the previous accounting period’s retained earnings carried over to the current accounting period. Typically dividend aristocrats that don’t see much value in reinvesting most of their profits because they have saturated their market. A term Peter Lynch uses in his books to describe company’s terrible attempts at diversification.

The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors’ or shareholders’ meetings. Under tax legislation, the company must send to the shareholder a certificate stating the amount of the dividend and the date of the payment. The law on dividends applies also to coupons payable on preference shares. Only profits available for the purpose, in accordance with company law rules and procedures, may be paid. The directors can be personally liable for the amount paid if they pay dividends unlawfully. Undistributed or retained earnings can be used to finance business growth, pay off liabilities, or pay dividends.

What Is the Expanded Accounting Equation?

For example, if a company sets the payout rate at 6%, it is the percentage of profits that will be paid out regardless of the amount of profits earned for the financial year. In fact, both management and the investors would want to retain earnings if they are aware that the company has profitable investment opportunities. And, retaining profits would result in higher returns as compared to dividend payouts. That is the amount of residual net income that is not distributed as dividends but is reinvested or ‘ploughed back’ into the company. A dividend depicts the payment of earnings as a distribution of its earnings. Preference shareholders have coupons attached to them, and they are paid dividends firstly before equity shareholders.

In law, these are profits that meet a test of being “realised profits”. Profits from normal trading activity are typically realised profits. Marketing and distribution of various financial products such as loans, deposits and Insurance are powered by Finzoomers Services Private Limited. Finzoomers got registered with IRDAI as Corporate Agent vide registration no.

The https://1investing.in/ are issued after identifying the market value of the subject property. This may happen when a company wants to save cash for operations/expansion. To calculate owner’s equity, subtract the company’s liabilities from its assets. This gives you the total value of the company that is shared by all owners. Retained earnings are corporate income or profit that is not paid out as dividends.

Investors contribute their share of (paid-in) capital as stockholders, which is the basic source of total stockholders’ equity. The amount of paid-in capital from an investor is a factor in determining his/her ownership percentage. It doesn’t matter which accounting method you’re using, you can still create a retained earnings statement.

Dividend Policy

As the how to calculate overtime pay suggests, retained earnings are dependent on the corresponding figure of the previous term. The resultant number may be either positive or negative, depending upon the net income or loss generated by the company over time. Alternatively, the company paying large dividends that exceed the other figures can also lead to the retained earnings going negative. Both cash and stock dividends reduce retained earnings by an amount equal to the size of the distribution. Cash dividends have a slightly different effect on the balance sheet in that they reduce both cash and retained earnings accounts by an amount equal to the size of the dividend.

- A company repurchased 1,000 shares of its $1 par value common stock for $5,000.

- When calculating ROE, you’ll use retained earnings to assess whether management is growing assets and profits.

- It is usually done in addition to a cash dividend, not in place of it.

During the growth phase of the business, the management may be seeking new strategic partnerships that will increase the company’s dominance and control in the market. The surplus can be distributed to the company’s shareholders according to the number of shares they own in the company. A company may also use the retained earnings to finance a new product launch to increase the company’s list of product offerings. For example, a beverage processing company may introduce a new flavor or launch a completely different product that boosts its competitive position in the marketplace. Retained earnings, on the other hand, are reported as a rolling total from the inception of the company. At the end of every year, the company’s net income gets rolled into retained earnings.

When calculating ROE, you’ll use retained earnings to assess whether management is growing assets and profits. The retained earnings or RE plays an important role to investors, management of the company, and shareholders. A customer buys a 30,000 INR refrigerator from your small appliance repair firm. This transaction might be reported as customer cash, lowering total assets but boosting retained profits. The income earned can be distributed among the shareholders in the form of dividends.

The 2024 Green Book and Tax Implications: A Primer – Lexology

The 2024 Green Book and Tax Implications: A Primer.

Posted: Mon, 20 Mar 2023 07:00:00 GMT [source]

The cash can be used for researching, purchasing company assets, marketing, capital expenditure among other activities that can support the company’s further growth. In a reverse stock split the reporting entity merges its outstanding shares to reduce the total number of shares outstanding and increase the per share stock price. A dividend should be recorded when it is declared and notice has been given to the shareholders, regardless of the date of record or date of settlement. As a practical matter, the dividend amount is not determinable until the record date. To record a dividend, a reporting entity should debit retained earnings and credit dividends payable on the declaration date. A dividend is a payment, either in cash, other assets , or stock, from a reporting entity to its shareholders.

Revenue and retained earnings have different levels of importance depending on what the underlying company is trying to achieve. Revenue is incredibly important, especially for growth companies try to establish themselves in a market. However, retained earnings may be even more important for companies who have been saving capital to deploy for capital expansion or heavy investment into the business. On the other hand, retained earnings is a “bottom-line” reporting account that is only calculated after all other calculations have been settled. Ending retained earnings is at the bottom of the statement of changes to retained earnings which is only assembled after net income (the “true” bottom line) has been determined. When revenue is shown on the income statement, it is reported for a specific period often shorter than one year.

- For solvent reporting entities, payment of dividends from retained earnings is almost always permissible.

- Retained earnings can be used to pay off existing outstanding debts or loans that your business owes.

- It is calculated over a period of time and assesses the change in stock price against the net earnings retained by the company.

- Thus, if you as a shareholder of the company owned 200 shares, you would own 20 additional shares, or a total of 220 (200 + (0.10 x 200)) shares once the company declares the stock dividend.

Retained earnings are impacted by revenues, operating expenses, cost of goods sold, and depreciation. Increased stocks This company gave you $20 in dividends, the same as January ($100). The decision of retaining profits earned is determined by the company’s management.