A decentralized exchange (DEX) is powered by an automated market maker (AMM), which allows assets to be exchanged utilizing crypto liquidity pools as counterparties rather than a traditional market of buyers and sellers. The liquidity pools in AMM-based decentralized exchanges include what is decentralized cryptocurrency exchange two crypto assets in a trading pair. Users have to deposit crypto assets in a similar ratio in the pool and become liquidity providers for the decentralized exchanges. Liquidity providers would receive a specific share of transaction fees for all trades executed on the concerned pair.

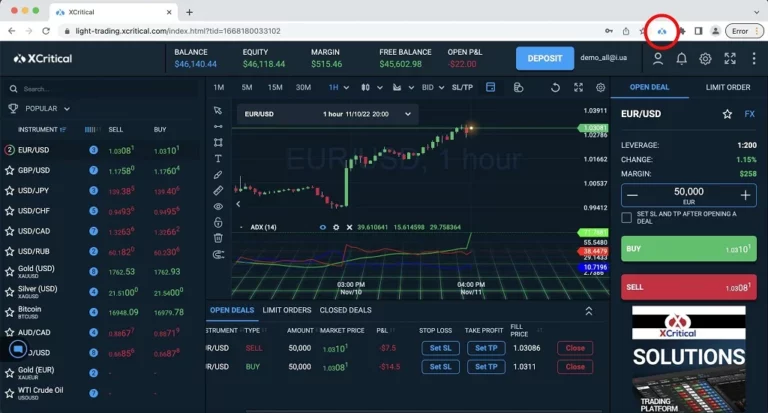

When your Bitcoin has arrived in your ViteX wallet, the next step is to click the trading icon on the top left side of the page and select your preferred coin pair (e.g., ETH/BTC) under the “Exchange” menu. It’s essential to double-check (or even triple-check) your wallet address to ensure that you are transferring your coins to the correct https://www.xcritical.in/ place. After you are ready, the service will generate you a mnemonic seed, which you can use to restore your ViteX wallet. On the other hand, you can take advantage of the DEX’s 24/7 customer support as well as rapid, user-friendly service. The order is either sent to the blockchain or off the chain with the maker’s signature.

It is important to point out that AMMs are limited by problems like arbitraging, front-running, and high transaction fees. The widespread popularity of holding and trading bitcoin and other crypto-assets has resulted from cryptocurrency being mainstream in our present day. Changelly DeFi Swap enables 3600+ token swaps on the Ethereum, Binance Smart Chain, Polygon, Fantom, Avalanche, and Optimism networks. As an aggregator, our platform always finds the best routes for your trades based on your requirements and guarantees to give you the best market rates.

In exchange for maintaining liquidity pools with their coins, providers receive a share of trading fees based on the proportion of their tokens in the pool. And attacks are not the only way centralized cryptocurrency exchanges have lost their customers’ funds in the past. In December 2019, the Canadian digital asset exchange, QuadrigaCX, allegedly lost $190 million from cold wallets that only the company’s deceased CEO had access to. Contrary to their centralized counterparts, you are in control of your private keys on DEXs. Users are enticed to become liquidity providers by automated market makers in exchange for a part of transaction costs and free tokens.

By the end of this article, readers will have a comprehensive understanding of DEXs and the role they play in shaping the future of finance. DEXs like Uniswap and Sushiswap, which are built on the Ethereum Blockchain Development Company, have gained significant popularity. These platforms utilize smart contracts to facilitate secure and transparent transactions. By leveraging blockchain technology, DEXs offer advantages such as greater user control over funds, increased privacy, and the ability to trade a wide range of assets.

DEXs allow crypto investors to hold their keys while trading by using liquidity solutions from order books to liquidity pools — and more. The Ethereum blockchain popularized smart contracts, which are the basis of DeFi, in 2017. For more information on the latest DEXs, and a comprehensive overview of decentralized and centralized exchanges see our page here. In this context, the primary goal of Bitcoin is to return the control of money to its owners, but we entrust our bitcoin to third-party services regularly. In the case of order book DEXs, the difference between buy orders and sell orders helps in evaluating the depth of their order book.

Using Chainlink decentralized oracle networks, dApps are able to retrieve off-chain price data in a simple, secure, and decentralized manner and execute actions based on that data. DEX users are typically required to pay two types of fees—network fees and trading fees. In addition to the aforementioned, some users could find the idea of having complete control over their private keys to be unsettling. One of the key advantages of the Web3 vision is having complete control over one’s assets, yet many users might prefer to entrust a third party with that responsibility. Network fees and trading fees are the two main types of expenses DEX users are normally expected to pay.

Thus, even with the privacy and decentralization features of crypto maintained, the users cannot enjoy complete anonymity and flexibility in operations with their coins. All CEXs are owned by particular companies or people who still charge some commission for the transactions. Thus, users get the benefits of large trade volumes and user-friendliness but need to forgo privacy to some extent and store their funds on the external website’s system, which increases the risk of hacking and theft. The most defining characteristic of decentralized crypto exchanges is having no third parties involved in transactions initiated on such platforms. Many DEXs do not support fiat currencies, allowing only crypto-to-crypto trades on their platforms. Due to the lack of national currencies, most decentralized exchanges don’t have to comply with regulations, which allows the solutions to offer services without KYC checks.

DEXes that use AMMs host pools of funds, called liquidity pools, where users (called liquidity providers) deposit their crypto. In traditional finance, market makers are participants—most often working for brokerages or other big institutions—who trade securities in high volumes. It also benefits the market makers themselves, because they benefit from small differences in the buy-ask spread. By placing hundreds of thousands of trades like this (or more), market making can be very lucrative. DEXs are less susceptible to this type of risk, since users can freely trade on these platforms from either cold or hot wallets without having to use their private keys or recovery seeds. Basically, the users are the ones in charge of maintaining the security of their accounts.

Users can contribute their cryptocurrency assets to liquidity pools, which are decentralised finance (DeFi) methods, to support trade. By maintaining balanced asset ratios and offering liquidity, users of these pools might earn fees. This promotes more seamless trade and enables users to actively engage in the DeFi ecosystem. A sort of decentralized exchange (DEX) protocol known as an automated market maker (AMM) uses a formula to determine the price of assets. Assets are valued using a pricing algorithm rather than an order book like a conventional exchange. According to available data, DEXs witnessed remarkable growth in the first quarter of 2023, with approximately $217 billion in transactions flowing through decentralized exchanges.

As more individuals and institutions recognize the benefits of decentralized finance, the demand for DEXs is likely to continue to rise. It is important to note that cryptocurrency investments carry risks, and individuals should do their own research and exercise caution before making any investment decisions. The subsidiary of the world’s largest crypto exchange, Binance DEX allows users to involve in decentralized trading and guarantees lower commissions coupled with better security of assets. Chainlink Automation can also be used to reliably perform the periodic distribution of trading fees and staking rewards.

- As DEXs do not rely on a central authority or intermediary, they are resistant to censorship and less likely to be impacted by changes in regulations.

- Chainlink Price Feeds can also be used as an additional backstop by DEXs looking to increase the resilience of their protocol to outlier market events, which a battle-tested source of price data can help protect against.

- One of the most well-known DEX platforms is Uniswap, built on the Ethereum blockchain.

- Instead, trades occur directly between users (peer-to-peer) through an automated process.

- DEXs execute trades and record them to the blockchain, enabling trustless transactions.

This article will help simplify what might seem like a complicated topic by comparing the two exchange models and highlighting these exchanges’ strengths and weaknesses presently. This is due to the requirement that the trade call be issued to the network first. As a result, DEXs are more prone to experience transaction execution issues when the value of the cryptocurrency being exchanged changes. Due to the fact that, unlike central exchanges, the liquidity of DEXs depends on the amount of people actively trading on the platform, DEXs often have problems in this area.

With automated analysis of spread between user orders, the DEX thus determines the asset’s current market price and the order book’s depth. Hybrid order book designs, in which the management and matching of orders take place off-chain while trade settlement takes place on-chain, have also grown in popularity. Technology advances over time are likely to substantially increase the use of DEXs. It is likely only a matter of time before using a decentralized exchange is a more common way to buy or sell cryptocurrency.